When automation means more human workers

A look at elasticity of demand

In my last few posts, I wrote about why radiologists have not been displaced by AI, in spite of rapid advancement in models that superficially appear to be as capable as their human counterparts. I suggested that understanding what happened (or didn’t) to radiologists would shed light on what we can expect for some other professions in the next few years.

But is radiology just a unique case? Let’s look at one argument I made in a recent Works in Progress article a little more closely: elasticity of demand. Even when models are capable of taking over some of a radiologist’s workload, I suggested in the piece, the ability to read scans cheaper and more quickly might actually cause an increase in demand for those scans. That increase, if large enough, could offset the additional assistance from AI and instead cause greater need for radiologists.

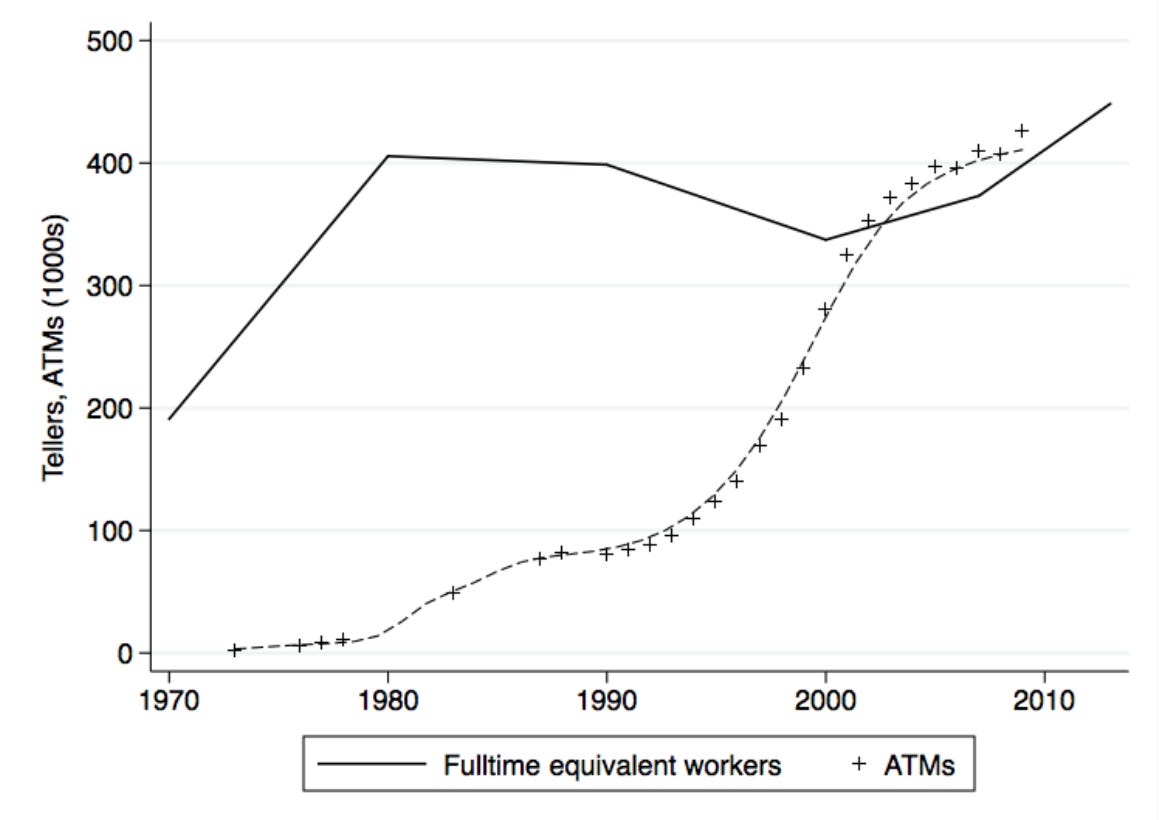

This isn’t without precedent. Elasticity of demand showed up when ATMs spread across the U.S. A study by James Bessen showed that teller employment rose during the 2000s, growing 2% annually, and he argued that this was not despite ATMs, but in part because of them.

Bessen used detailed U.S. occupational data from 1980 to 2013 to analyze how computer use affected job growth, skill demands, and wage distribution across over 300 occupations. His estimates controlled for factors like offshoring and industry-level demand shifts, allowing him to isolate the specific effects of computer automation.

He suggested that, by reducing the cost of operating bank branches, ATMs made it economically viable for banks to open more locations — expanding, rather than contracting, teller employment. He supports the claim not through a formal causal estimate, but rather through historical correlation and economic reasoning: employment rose during the period of ATM adoption, and theory suggests that automation can increase demand for complementary labor when it lowers costs.

The assumption that productivity gains would translate to fewer workers didn’t hold because the demand for the service wasn’t fixed. Some of that demand may have been previously suppressed by supply constraints — for example, if limited branch hours and long lines had kept some customers from doing as many transactions as they wanted — and more of it might have been stimulated by new capabilities, expectations, and incentives. Rather than remaining constant, demand expanded as the effective supply increased, a dynamic similar to a rightward shift in the supply curve, where prices fall and the equilibrium quantity rises.

ATMs automated routine cash-handling but left tellers doing everything from fraud detection to retirement account setup. Far from replacing tellers, automation reallocated their time; they focused more on customer service and cross-selling. The teller example illustrates a broader pattern in Bessen’s research: occupations that adopted computers often grew faster than those that didn’t, partly by substituting for other jobs in the same industry. At the same time, computerization tends to increase wage inequality within occupations, as only some workers acquire the new, valuable skills these technologies demand.

This pattern is called Jevons paradox. When technological advancement makes something cheaper or more efficient to use, this can conversely result in more use if demand increases as the cost declines, and this effect dominates. It’s often used in the context of goods — for example, the increased efficiency of using coal leading to the consumption of coal in more industries and a net increase in coal consumption.

Since then, however, it’s been applied to professions where increased efficiency means that one would need fewer people to do the same amount of work — but that increase in efficiency means that work can get done faster and more cheaply, resulting in more people demanding it. That the advent of spreadsheets resulted in more demand for accountants, rather than less, is another commonly-cited example.

In legal services, there may be a similar effect. Predictive-coding tools can reduce the burden of document review in large-scale litigation. But instead of cutting legal headcount, they enable lawyers to take on larger or more complex cases. Firms still staff teams with associates, but now those associates may integrate the AI’s outputs into strategic decision-making, respond to its limitations, and navigate risk in higher-stakes environments. The work shifts upward: demand has grown, but especially for specialists. A 2017 paper by Dana Remus and Frank Levy estimated that, even under widespread adoption of e-discovery AI, the net effect on overall legal employment would be modest. The tasks that remain require context, interpretation, and discretion, and these are skills that machines still struggle to emulate.

But this dynamic has its limits. Economists distinguish between the scale effect, where cheaper and faster services expand output and increase labor demand, and the substitution effect — where machines directly replace human inputs. When automation reduces costs modestly, the scale effect can dominate, like with ATMs and bank tellers. But if productivity gains come very quickly and are extreme, demand growth can’t keep pace indefinitely.

In the case of bank tellers, online and mobile banking was a stronger substitute for their skills, and the potential for additional demand didn’t compensate for that. As a result, employment in the role has declined by ~30% since 2010. This applies across roles: if the technological advancement either completely substitutes for all tasks needed or introduces efficiency gains so large they outstrip any potential increase in demand, then employment in the role will fall rather than rise.

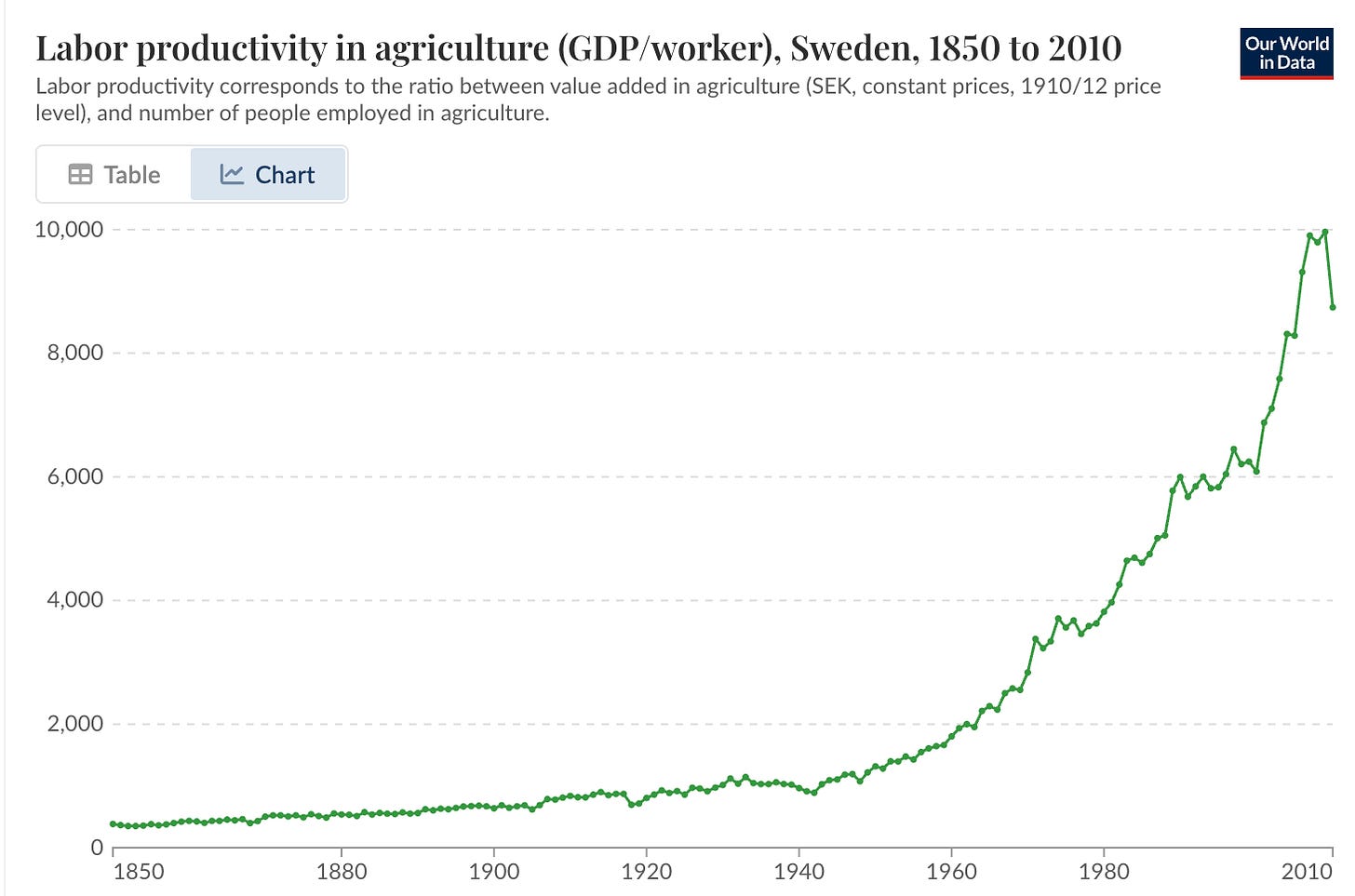

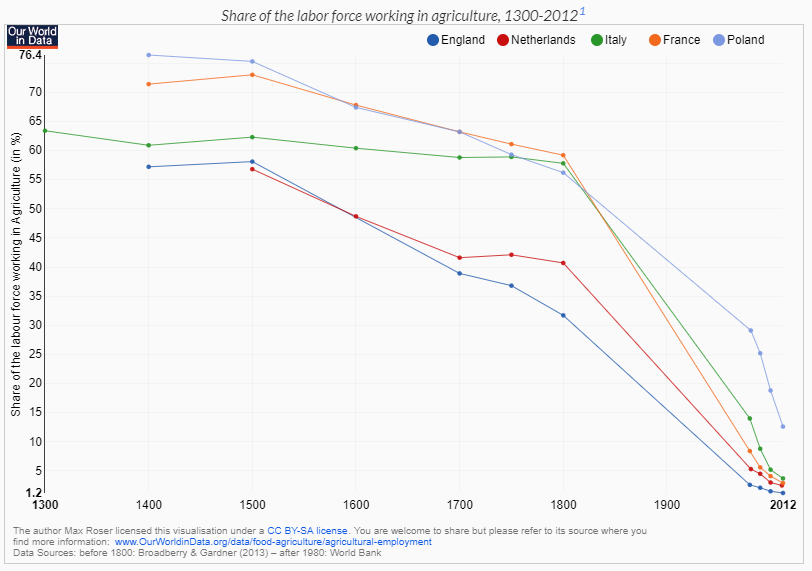

In radiology, for instance, patients will likely never need a thousand times more scans than they do today, no matter how cheap they become. Once demand saturates, the substitution effect takes over, and employment declines. We’ve already seen this dynamic in industries like textiles and agriculture, where mechanization enabled massive output growth but ultimately displaced large numbers of workers once consumption hit a natural ceiling.

Elasticity of demand complicates the story of automation. Cheaper, faster tools don’t always shrink the need for human labor; they can expand it by unlocking suppressed demand or creating new tasks that complement machines. That pattern, visible in radiology, banking, and law, suggests that automation’s most durable legacy may not be mass displacement, but reallocation — reshaping what workers do and where expertise is needed.

However, this requires several things to be true:

Technological change results in increased efficiency, but does not entirely substitute for the role

The efficiency boost lowers the cost of use — this can be non-monetary, for example, in the case of faster turn-around of scan results

That lower cost results in more demand for the service

The magnitude of the demand increase outstrips the increase in efficiency in impact

The balance between scale and substitution is not fixed. In my next piece, I’ll turn to the other side of the ledger: when substitution overwhelms scale, and what characterizes professions where automation does quickly reduce the need for human workers.

Deena; this is such an insightful read; if one will achieve the scale effect vs the substitution effect with automation is such a great question to ask.